Here’s what happened in crypto today

2025-05-14

crypto today">

crypto today">

Today in crypto, Twenty One Capital had a $458.7 million worth of bitcoin injection from Tether, VanEck is launching its first tokenized fund backed by US Treasurys, and Arizona Governor Katie Hobbs has vetoed bills aimed at creating a state Bitcoin reserve and enabling crypto payments.

Tether injects $459M Bitcoin into Twenty One Capital

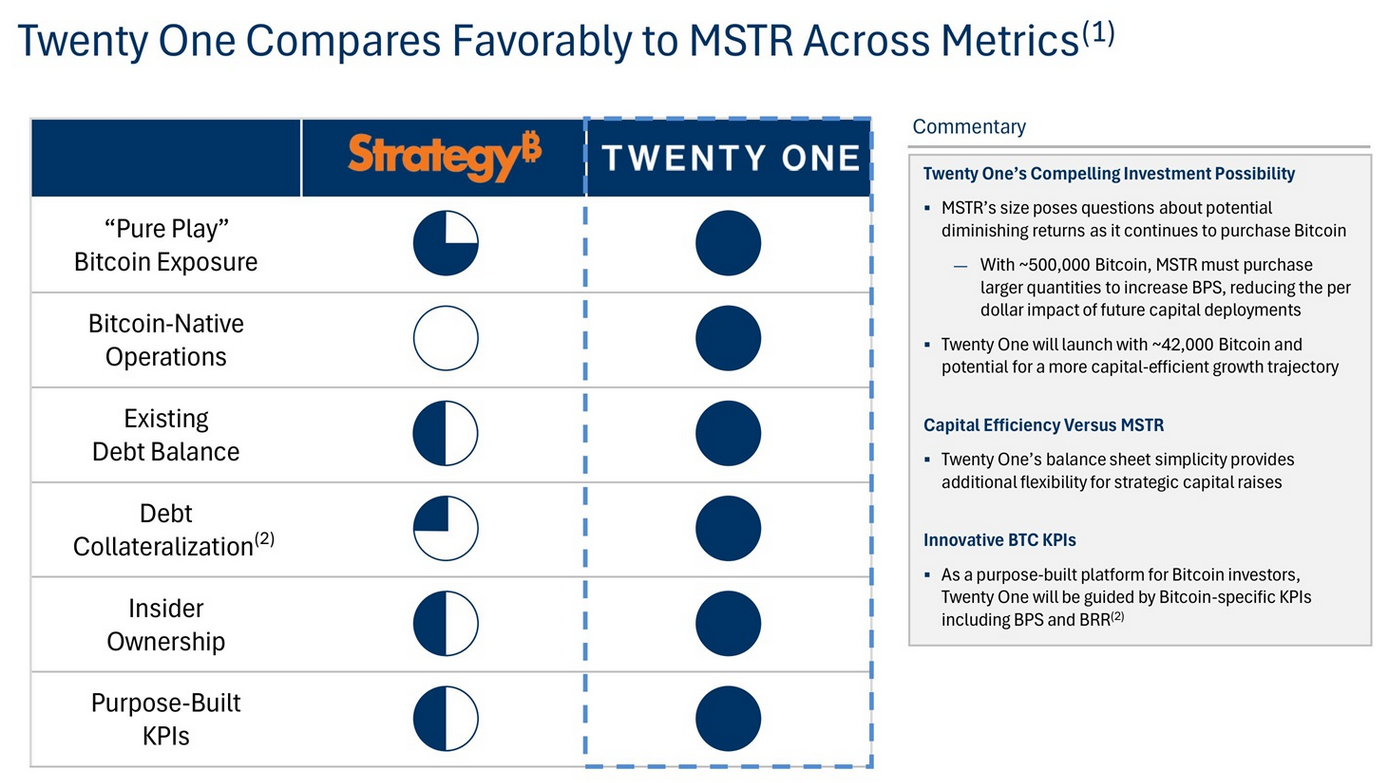

Stablecoin issuer Tether bought $458.7 million worth of Bitcoin for Twenty One Capital on May 13, a Bitcoin investment firm it backed that’s working on a Special Purpose Acquisition Company (SPAC) merger with Cantor Equity Partners.

Cantor Equity Partners said in a regulatory filing that Tether scooped 4,812.2 Bitcoin (BTC) at $95,319 each and put it in an escrow wallet on May 9.

Twenty One’s total Bitcoin holdings have now swollen to 36,312 BTC, as Cantor Equity Partners holds 31,500 BTC for the firm, which will trade under the ticker XXI once the SPAC merger is complete.

Its Bitcoin holdings are the third-largest among public companies, trailing only Strategy, formerly MicroStrategy and Bitcoin mining firm MARA Holdings at 568,840 Bitcoin and 48,237 Bitcoin, respectively.

VanEck to launch its first RWA tokenization fund

Investment firm VanEck is launching a tokenized real-world asset (RWA) fund that offers exposure to US Treasury bills, developed in partnership with tokenization platform Securitize. The initiative places VanEck among a growing number of traditional finance firms entering the RWA tokenization space.

The fund, called VBILL, will be initially available on Avalanche, BNB Chain, ethereum and Solana blockchains, VanEck said in a May 13 statement. The fund's minimum subscriptions start at $100,000 for investments running on Avalanche, BNB Chain, and Solana, while the minimum subscription on Ethereum is $1 million.

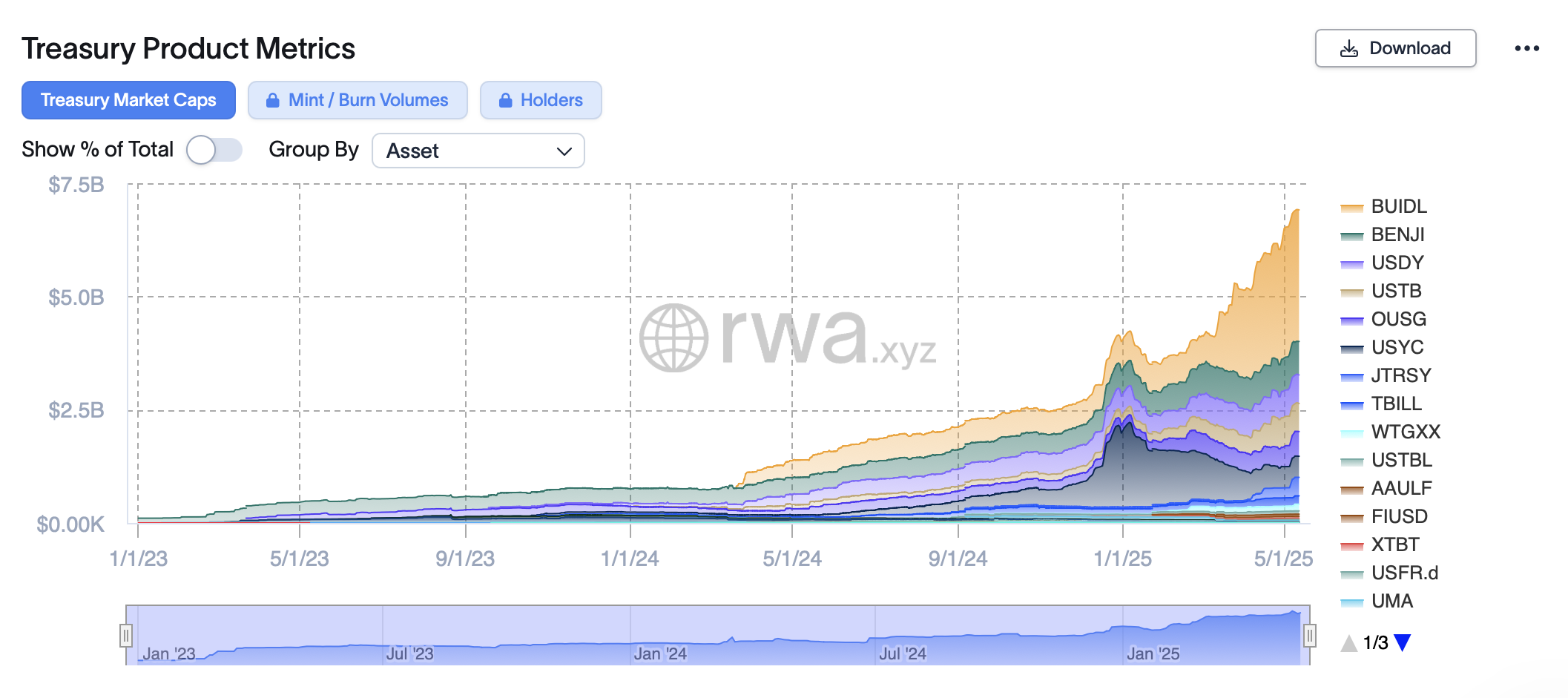

VanEck joins a burgeoning field of traditional financial firms that have launched RWA tokenized funds, with competitors including BlackRock and Franklin Templeton. In January, Apollo, an investment firm with $751 billion in assets under management, also launched a private credit tokenized fund.

With a market capitalization of $6.9 billion, US Treasurys are among the largest asset classes in tokenized funds, second only to private credit, according to data from RWA.xyz.

VanEck’s partner, Securitize, has tokenized over $3.9 billion in assets. In May 2024, it raised $47 million in a strategic funding round led by BlackRock.

Arizona governor kills two crypto bills, cracks down on Bitcoin ATMs

Arizona Governor Katie Hobbs vetoed two key cryptocurrency-related bills that aimed to expand the state’s involvement in digital assets while signing a strict regulatory measure targeting Bitcoin ATMs.

On May 12, Hobbs rejected Senate Bill 1373, which sought to establish a Digital Assets Strategic Reserve Fund. The fund would have allowed Arizona to hold crypto assets obtained through seizures or legislative allocations.

“Current volatility in cryptocurrency markets does not make a prudent fit for general fund dollars,” she stated in her veto letter. “I have already signed legislation this session which allows the state to utilize cryptocurrency without placing general fund dollars at risk,” she added.

That decision followed her veto of Senate Bill 1025 — the more ambitious “Arizona Strategic Bitcoin Reserve Act” — on May 3. It would have authorized up to 10% of the state’s treasury and retirement funds to be invested in Bitcoin and other digital assets.

According to data from bitcoinlaws.io, 26 US states have introduced strategic crypto reserve bills, with 18 of them currently active.

Hobbs also vetoed Senate Bill 1024, which would have permitted state agencies to accept cryptocurrency payments for taxes, fines and fees via approved service providers.

defi Newsletter">