Here’s what happened in crypto today

2025-05-15

crypto today">

crypto today">

Today in crypto, a CFTC commissioner is set to become the next CEO of the crypto advocacy group blockchain Association. Meanwhile, banking giant UBS reports that high-net-worth clients in Asia are shifting away from US dollar assets in favor of gold, crypto, and Chinese markets. Elsewhere, Twenty One Capital has received a $458.7 million injection in bitcoin from Tether.

CFTC commissioner will step down to become Blockchain Association CEO

Summer Mersinger, one of four commissioners currently serving at the US financial regulatory body Commodity Futures Trading Commission (CFTC), will become the next CEO of the digital asset advocacy group the Blockchain Association (BA).

In a May 14 notice, the Blockchain Association said its current CEO, Kristin Smith, would step down for Mersinger on May 16, allowing an interim head of the group to work until the CFTC commissioner assumes the role on June 2. Though her term at the CFTC was expected to last until April 2028, the BA said Mersinger is set to leave the agency on May 30.

The departure of Mersinger, who has served in one of the CFTC’s Republican seats since 2022, opens the way for US President Donald Trump to nominate another member to the financial regulator. Rules require that no more than three commissioners belong to the same political party.

Like the Securities and Exchange Commission, the CFTC is one of the significant US financial regulators whose policies impact digital assets. Lawmakers in Congress are currently working to pass a market structure bill to clarify the roles each agency could take in overseeing and regulating crypto.

New leadership at the Blockchain Association had been expected since Smith announced her departure on April 1 to become the next president of the Solana Policy Institute.

Asia’s wealthy shifting from US dollar to crypto, gold, China: UBS

High-net-worth clients across Asia are gradually pivoting away from US dollar-based investments, favoring gold, cryptocurrencies and Chinese assets instead, according to financial services giant UBS Group.

“Gold is getting very popular,” Amy Lo, the Swiss bank’s co-head of wealth management for Asia, said during Bloomberg’s New Voices event held in Hong Kong on May 13.

She cited rising geopolitical uncertainty and persistent market volatility as primary factors behind the shift. Investors, traditionally concentrated in US-centric assets, are now seeking broader exposure across alternative asset classes, including crypto, commodities and other currencies.

Lo said “volatility is definitely here to stay,” prompting clients to rebalance toward perceived safe havens and growth opportunities in new regions.

China, after years of muted interest, is also regaining traction among the ultra-wealthy. Lo noted that clients who previously avoided exposure to China are now proactively asking about investment opportunities.

Hong Kong’s benchmark index, heavily composed of Chinese companies, has emerged as one of the world’s top performers in 2024, further fueling interest.

Bank of America’s latest fund manager survey also shows that global fund managers significantly reduced their exposure to the US dollar in May, marking the largest underweight position in 19 years.

Tether injects $459 million Bitcoin into Twenty One Capital

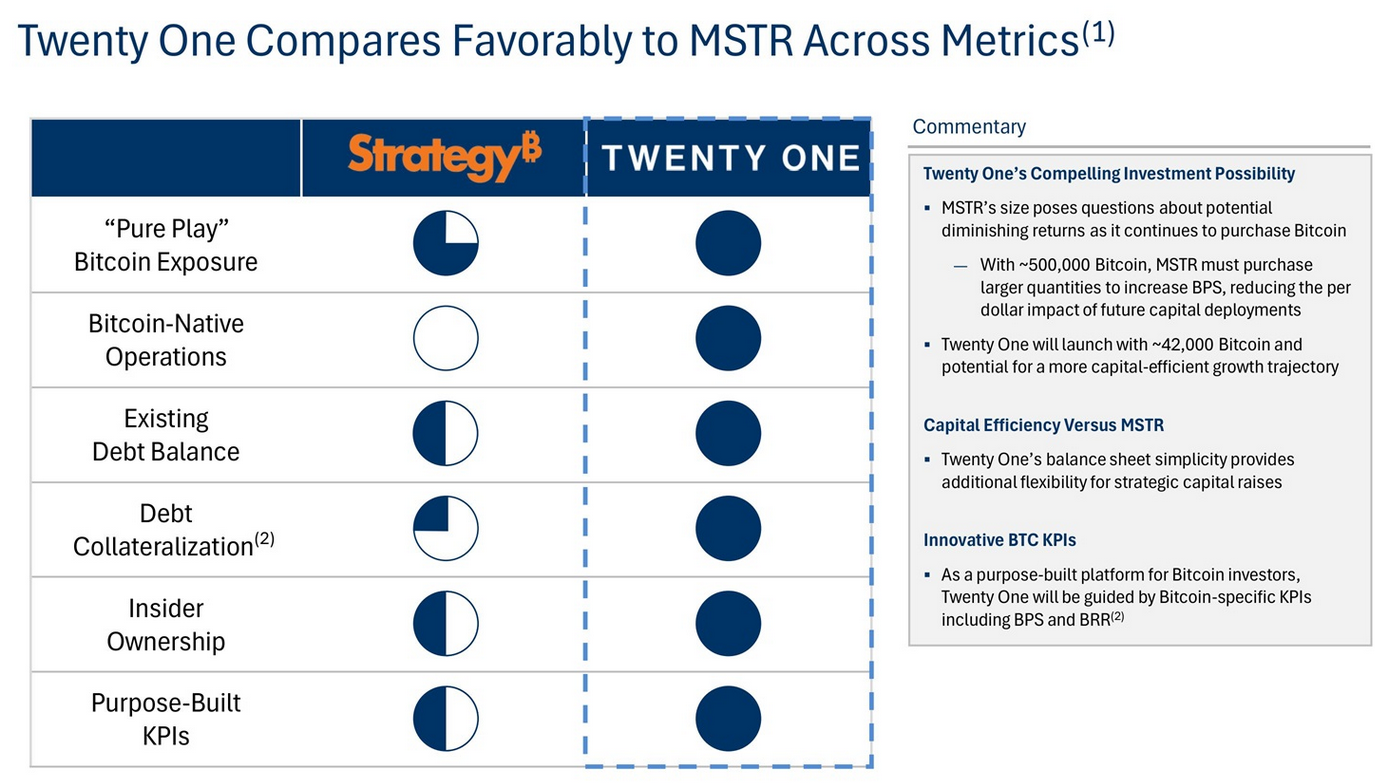

Stablecoin issuer Tether bought $458.7 million worth of Bitcoin for Twenty One Capital on May 13, a Bitcoin investment firm it backed that’s working on a Special Purpose Acquisition Company (SPAC) merger with Cantor Equity Partners.

Cantor Equity Partners said in a regulatory filing that Tether scooped 4,812.2 Bitcoin (BTC) at $95,319 each and put it in an escrow wallet on May 9.

Twenty One’s total Bitcoin holdings have now swollen to 36,312 BTC, as Cantor Equity Partners holds 31,500 BTC for the firm, which will trade under the ticker XXI once the SPAC merger is complete.

Its Bitcoin holdings are the third-largest among public companies, trailing only Strategy, formerly MicroStrategy and Bitcoin mining firm MARA Holdings at 568,840 Bitcoin and 48,237 Bitcoin, respectively.

VanEck to launch its first RWA tokenization fund

Investment firm VanEck is launching a tokenized real-world asset (RWA) fund that offers exposure to US Treasury bills, developed in partnership with tokenization platform Securitize. The initiative places VanEck among a growing number of traditional finance firms entering the RWA tokenization space.

The fund, called VBILL, will be initially available on Avalanche, BNB Chain, ethereum and Solana blockchains, VanEck said in a May 13 statement. The fund's minimum subscriptions start at $100,000 for investments running on Avalanche, BNB Chain, and Solana, while the minimum subscription on Ethereum is $1 million.

VanEck joins a burgeoning field of traditional financial firms that have launched RWA tokenized funds, with competitors including BlackRock and Franklin Templeton. In January, Apollo, an investment firm with $751 billion in assets under management, also launched a private credit tokenized fund.

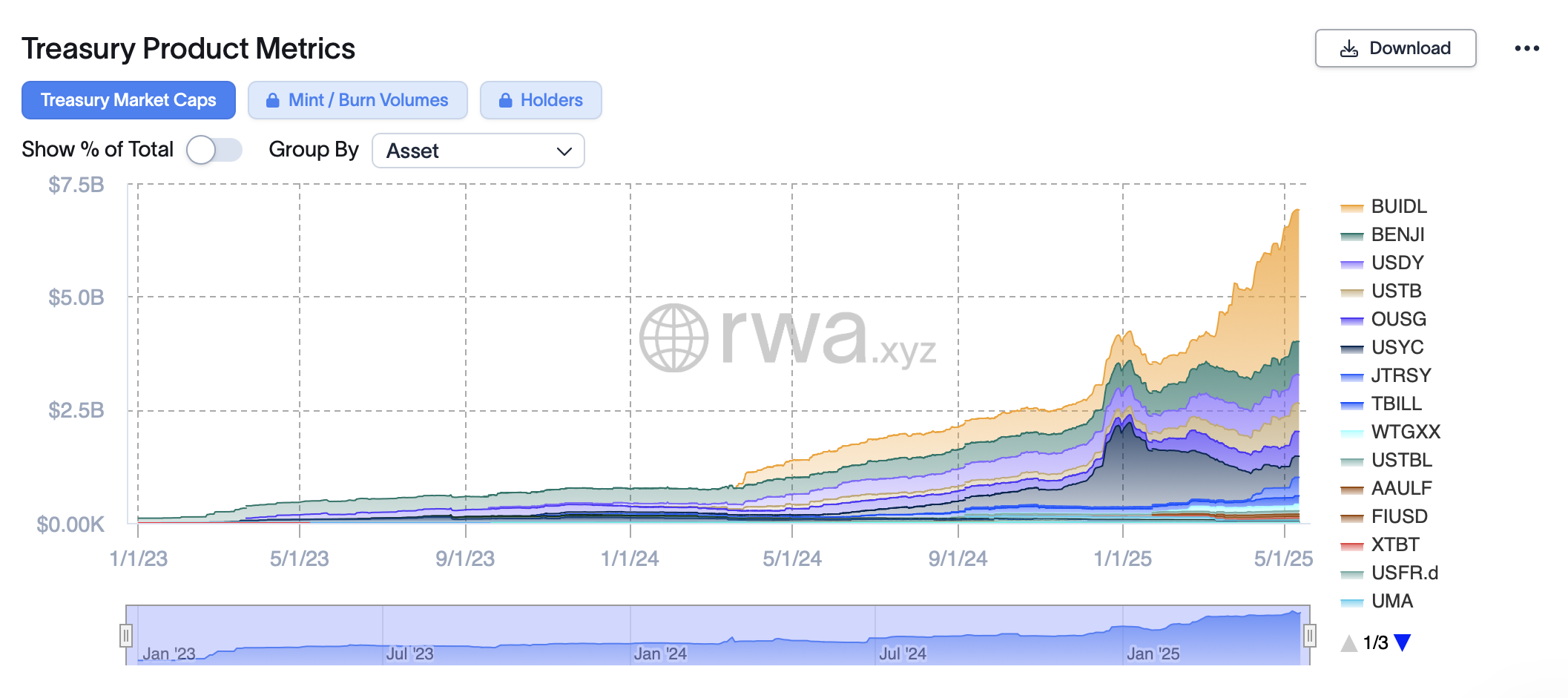

With a market capitalization of $6.9 billion, US Treasurys are among the largest asset classes in tokenized funds, second only to private credit, according to data from RWA.xyz.

VanEck’s partner, Securitize, has tokenized over $3.9 billion in assets. In May 2024, it raised $47 million in a strategic funding round led by BlackRock.